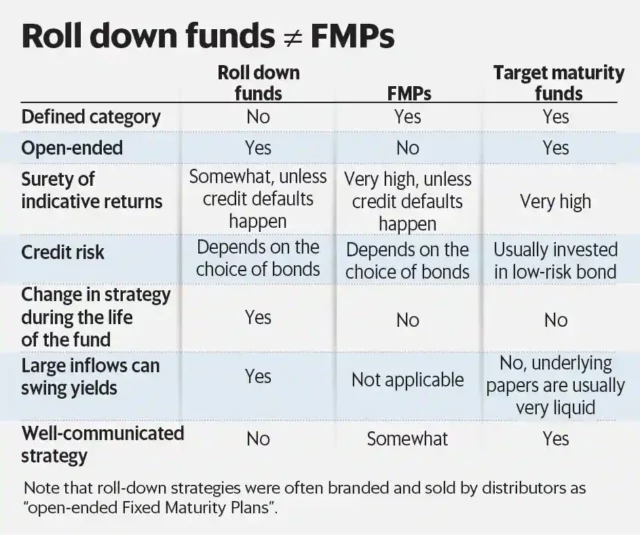

Not every scheme with a roll-down strategy is an FMP

Post a string of defaults by some big companies in 2018-’19, investors were averse to locking in money in fixed income. Hence, the popularity of FMPs (Fixed Maturity Plans) waned somewhat as people preferred open-ended funds as they could exit if there were indications of downgrade/default in a particular underlying paper. This was the period when many funds started following a rolldown strategy on the open-ended funds’ platform. The funds where these strategies were applied were already part of categories defined by the market regulator Sebi andinclude corporate bonds, banking & PSU debt, dynamic bonds. These roll-down strategies were often branded and sold by distributors as “open-ended Fixed Maturity Plans”.

The strategy employed by these funds was not new. The fund manager would align the fund in a particular part of the yield curve and only buy papers in those maturities. For example, if the fund is running a 4-year roll down strategy, it would buy 4-year maturity papers in year 1 and 3-year maturity papers in year 2, and so on.

The Issues

Firstly, when a fund repositions its portfolio to follow a roll-down strategy, it need not alter its offer documents or communicate it to a wider audience before such repositioning. In many cases, this kind of repositioning was made in tacit understanding with a lead distributor for garnering large flows into the funds. So, most retail investors would never hear about these strategies and often invest in these funds on the basis of the aforementioned categories.. More importantly, when the ‘strategy’ is ending, it may not be communicated on a timely basis to all investors.

Secondly, unlike FMPs, wherein a yield is locked in for the investor, those who invest in an open-ended rolldown fund will not have completely fixed holdings, as in an FMP. The fund manager can attempt to buy similar maturity papers as per plan but various factors can affect these transactions. Large exits or inflows (it’s an open-ended fund) have a tendency to disrupt the plan. For example, the manager may not get enough supply of papers in the defined maturities, and that leads to mismatched buys.

Thirdly, and most importantly, the funds can change this strategy even before the plan has played out. Consider that there is still 1 year to go for the fund to roll down, and the modified duration (interest rate change sensitivity) is low. But the manager decides to alter the strategy and starts buying 5-year maturity papers (where only 1-year papers should be bought as per plan). This increased allocation to longer-term papers suddenly increases the fund’s sensitivity to interest rate changes and can negatively affect your returns if the interest rates start moving up. While this could be communicated via distributors, many investors (both retail and high networth investors) do not understand much of the mechanics involved to be able to take a call.

The Better Options

Many of the issues highlighted earlier are being catered to with the launch of Target maturity funds (TMFs) which are passive funds in defined maturity products. The portfolio in TMFs is clearly defined and often includes papers that have enough liquidity. Also, all information about these products is available on all investment websites.

This was originally published in Mint on 03 May 2022