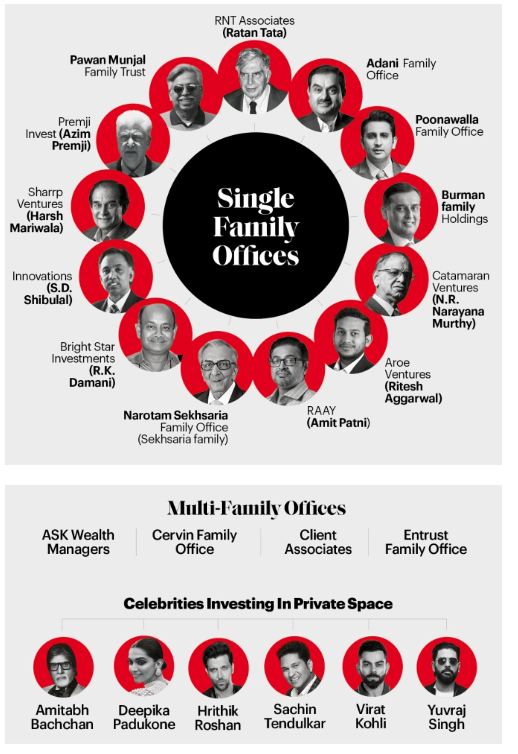

Decoding Family Offices Landscape In India

In the US, Europe or other countries, one may find family offices that have been around for as long as more than 70 years. However, in India, the term family office is quite nascent in comparison to the West.

How Sebi is all set to make AIFs more investor-friendly

Winds of change are set to sweep the investment scenario in the country. The Securities and Exchange Board of India (Sebi) has proposed to curb mis-selling of alternative investment funds (AIFs) and make them more investment friendly. The market regulator released three consultation papers to this effect last week.

What do global REITs offer… And, what they certainly do not

Buying real estate overseas is not new to rich Indian investors. But buying physical real estate can be cumbersome. Apart from a physical recce of available properties, it entails managing the documentation, specific licenses and repairs -- a taxing process. Nevertheless, if you have financial interests overseas, investing in real estate may hold long- term appeal. One way to get exposure to overseas real estate without having to buy physical property is investment in REITs.

REITs, or Real Estate Investment Trusts, are special companies set up to own and manage real estate assets. REITs do not invest in just one property. Think of REITS like a mutual fund. A REIT invests in a portfolio of properties across sectors.

REITs, or Real Estate Investment Trusts, are special companies set up to own and manage real estate assets. REITs do not invest in just one property. Think of REITS like a mutual fund. A REIT invests in a portfolio of properties across sectors.

Family Offices: Preserving Wealth

Munish Randev, founder and CEO of CERVIN Family Office, says a family with ₹100 crore and more financial capital needs family office. Industry players say a single-family office is needed if liquid wealth is more than ₹2,000 crore.

Team quality and continuity also matter. For example, a promoter set up a single family office where five out of six professionals had only sales experience. "The promoter had no idea that corporate bankers and mutual fund distributors are not experienced in wealth management. Hands-on investing experience is most important in an internal investment team," says Randev. If a single-family office doesn't offer meaningful work or intellectual stimulation, the professionals may move on. Such things can be avoided by opting for a multi-family office which can manage both investment and non-investment needs.

The CIO's job is not easy. Sometimes he needs to raise the red flag to the business owner's investment preferences. "We can't be yes men. For example, a lot of clients asked us to invest in cryptos or other glamorous products because their friends and acquaintances were doing so. We explained the risks but not all agreed," says Randev of CERVIN Family Office.

Family offices keep a check on spending habits too. "Most families get astonished when they take stock of their expenses. Sometimes we even have to highlight why they shouldn't buy a ₹1-2 crore car every year or go on a lavish vacation of ₹2 crore or buy diamond on every other occasion. If there are risky patterns, we highlight them. It's up to them to follow," says Randev.

Team quality and continuity also matter. For example, a promoter set up a single family office where five out of six professionals had only sales experience. "The promoter had no idea that corporate bankers and mutual fund distributors are not experienced in wealth management. Hands-on investing experience is most important in an internal investment team," says Randev. If a single-family office doesn't offer meaningful work or intellectual stimulation, the professionals may move on. Such things can be avoided by opting for a multi-family office which can manage both investment and non-investment needs.

The CIO's job is not easy. Sometimes he needs to raise the red flag to the business owner's investment preferences. "We can't be yes men. For example, a lot of clients asked us to invest in cryptos or other glamorous products because their friends and acquaintances were doing so. We explained the risks but not all agreed," says Randev of CERVIN Family Office.

Family offices keep a check on spending habits too. "Most families get astonished when they take stock of their expenses. Sometimes we even have to highlight why they shouldn't buy a ₹1-2 crore car every year or go on a lavish vacation of ₹2 crore or buy diamond on every other occasion. If there are risky patterns, we highlight them. It's up to them to follow," says Randev.

Why more family offices in India are investing in start-ups

Munish Randev, Founder & CEO of Cervin Family Office and Advisors, said it was very natural for Indian family offices to start allocating to the start-up space. The key reason is the asset class has grown rapidly in India over the last 10 years and hence provides numerous opportunities.

The momentum of newer founders and start-ups has ensured that there is enough capital entering the industry which has provided the necessary boost, thereby attracting attention from the growing list of family offices, Randev said.

Indian start-ups achieving a fairy tale valuation growth, the increasing buzz around unicorns and stories of multiples of capital made from the industry has attracted the nextgen from family offices who are more comfortable in taking risks.

At the same time, Randev also pointed out that some family offices have just dived headlong into the start-up ecosystem purely due to social/peer pressures (within a family office) or just ‘Fear of Missing Out’ (FOMO).

Published in The Hindu BusinessLine, 24 July, 2022

The momentum of newer founders and start-ups has ensured that there is enough capital entering the industry which has provided the necessary boost, thereby attracting attention from the growing list of family offices, Randev said.

Indian start-ups achieving a fairy tale valuation growth, the increasing buzz around unicorns and stories of multiples of capital made from the industry has attracted the nextgen from family offices who are more comfortable in taking risks.

At the same time, Randev also pointed out that some family offices have just dived headlong into the start-up ecosystem purely due to social/peer pressures (within a family office) or just ‘Fear of Missing Out’ (FOMO).

Published in The Hindu BusinessLine, 24 July, 2022

Succession Planning is taking centre-stage

Impact of Covid: Focus shifts to succession planning

Published in The Hindu BusinessLine, 3 August, 2021

Published in The Hindu BusinessLine, 3 August, 2021

How to invest in companies before they go public?

Kotak Investment Advisors Ltd is launching a pre-initial public offering fund with a target size of ₹2,000 cr.

Published in Mint, 4 June, 2021

Published in Mint, 4 June, 2021

Indian investors are pouring money into this 'ESG' funds

Five new funds launched last year managed to attract $716m in new money.

Published in Citywire, 5 Feb, 2021

Published in Citywire, 5 Feb, 2021

India's Cervin Upbeat Over Country's Family Office Sector

The vast majority of Indian businesses are run and owned by families

Published in WealthBriefing Asia, 6 Jan 2021

Published in WealthBriefing Asia, 6 Jan 2021

Investment strategies for uncharted waters

Surrounded by unprecedented risks, family investors in Asia are looking to extract any available upside from a tricky environment

Published in Risk.net, 18 Dec 2020

Published in Risk.net, 18 Dec 2020

Achieving portfolio transparency with AMCs

Actively managed certificates (AMCs) are set to take off in Asia as family investors look for portfolio visibility

Published in Risk.net, 18 Dec 2020

Published in Risk.net, 18 Dec 2020

Invesco Mutual Fund bets on digital lifestyle with Global Consumer Trends Fund

The underlying fund is dominated by e-commerce

Published in Mint, 11 Dec 2020

Published in Mint, 11 Dec 2020

Zerodha co-founder’s hedge fund clocks 40% return in first year of launch

Zerodha’s co-founder Nikhil Kamath

Published in Mint, 26 Nov 2020

Published in Mint, 26 Nov 2020

Cervin Family Office Spreads its Message Across India’s World of Wealth Management

Cervin offers a core set of services to its clients

Published in Hubbis Nov 13, 2020

Published in Hubbis Nov 13, 2020

NFOs in vogue while established schemes see outflows

Investors are putting more faith in the new equity fund offers by mutual funds than established products these days.

Published in Economic Times, Oct 19, 2020

Published in Economic Times, Oct 19, 2020

Market Views: Will anything derail the tech stock surge?

With Covid-19 driving technology share prices to record levels, even the threat of tighter regulation in the US has had little impact on valuation

Published in Asian Investor, Sep 1, 2020

Published in Asian Investor, Sep 1, 2020

Managing the interests of wealthy families

Cervin Family Office offers advisory, governance, strategy and financial planning services

Published in The Hindu Business Line, 03 Aug, 2020

Published in The Hindu Business Line, 03 Aug, 2020

How the super rich invested during the covid-19 pandemic

Family offices often make headlines for their investments in startups or private equity.

Published in Mint, 29 Jun 2020

Published in Mint, 29 Jun 2020

Former multi-family office CIO starts independent outfit

Cervin Family Office, which has a five-strong team in Mumbai, is currently onboarding

Published in Citywire, 8 June, 2020

Published in Citywire, 8 June, 2020

Should you access debt funds only with the help of advisers?

From left) Lakshmi Iyer, of Kotak Mutual Fund, Ganesh Ram of BSE, Munish Randev and Gaurav Mashruwala of Gauravmashruwala.com

Published in Mint, 16 Mar 2020

Published in Mint, 16 Mar 2020